10 Budgeting Hacks to Supercharge Your Savings: Spend Less, Save More

In today's fast-paced world, managing finances can be daunting. With rising living costs and unplanned expenses cropping up, it's crucial to find ways to stretch every dollar further. What if I told you that there are simple hacks you can incorporate into your daily life to supercharge your savings? By implementing these budgeting tricks, you can spend less and save more, giving you the freedom to focus on what truly matters.

Whether you're looking to pay off debt, save for a big purchase, or build an emergency fund, these budgeting hacks will help you navigate your finances more effectively. From changing your spending habits to using technology, each tip is designed to simplify your financial journey and maximize your savings potential. Let's dive into the ten budgeting hacks that can transform your financial landscape.

By adopting just a few of these tips, you'll be well on your way to financial stability and peace of mind. It's time to take control of your finances and watch your savings grow.

1. Automate Your Savings

The first step toward better savings is to automate your finances. Setting up automatic transfers from your checking account to your savings account can make a significant difference over time. When you automate your savings, you ensure that a portion of your paycheck goes directly toward your savings goals without you having to think about it.

By making savings a non-negotiable part of your budgeting strategy, you can avoid the temptation to spend that money. Consider treating savings like a bill you have to pay each month, creating a financial safety net that grows effortlessly.

- Set up automatic transfers each payday.

- Use a high-interest savings account for maximum growth.

- Consider dedicating savings for specific goals, like vacations or emergencies.

In essence, automating your savings can simplify the process and help you build wealth without the effort. The less you have to think about saving, the more likely you are to stick to the plan.

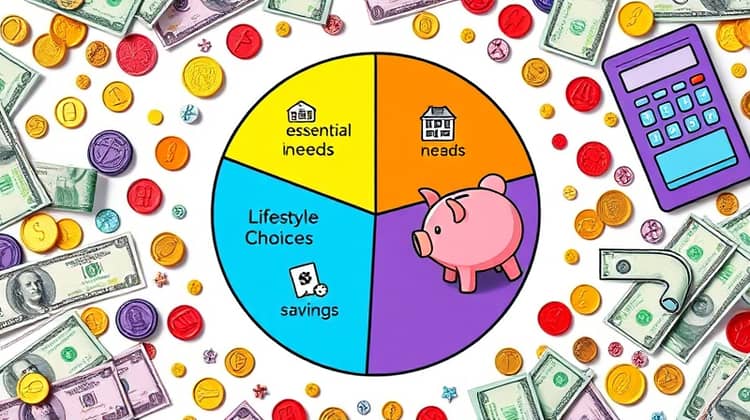

2. Use the 50/30/20 Rule

The 50/30/20 rule is a straightforward approach to budgeting that divides your income into three main categories: needs, wants, and savings. According to this rule, 50% of your income should go towards essential needs, like housing and groceries, 30% towards lifestyle choices and entertainment, and the remaining 20% should be set aside for savings or debt repayment.

This clear structure can help you prioritize your expenses and ensure that you're not overspending in one area while neglecting another. You might be surprised to find that you can cut back on unnecessary spending, allowing you to bolster your savings significantly.

Implementing the 50/30/20 rule requires discipline and honesty about your spending habits. It's essential to keep track of where your money goes, adjusting your budget as necessary to stay within these guidelines.

3. Embrace Cashback and Rewards

Cashback and rewards programs are an effective way to make your purchases work for you. By leveraging credit cards that offer cashback on regular expenses or rewards for travel, you can easily add to your savings without any extra effort. Just be sure to pay off your credit card balance in full to avoid interest fees.

Many banks and financial institutions offer programs that provide rewards for using their services. Take time to research and find the best options that suit your lifestyle.

- Sign up for cashback credit cards that align with your spending.

- Use apps that offer cashback for specific retailers.

- Take advantage of reward programs at your favorite stores.

By harnessing the power of cashback and reward programs, you can essentially “get paid” for spending on things you would already purchase. This can significantly contribute to your overall savings.

4. Download a Budgeting App

In our digital age, there's an app for just about everything, including budgeting. Budgeting apps can provide insights into your spending habits, allocate your funds automatically, and remind you of your financial goals. By using a budgeting app, you can have a clear overview of your financial situation right at your fingertips.

Many apps offer features that allow you to link your bank accounts, categorize expenses, and set spending limits. This real-time tracking can help you stay on top of your finances and make informed decisions about your spending behavior.

Additionally, budgeting apps can simplify the process of budget adjustments, as they provide easy ways to reassess and realign your financial goals.

5. Cut the Cord

The trend of cutting the cable cord has been on the rise for years, and it’s a major area where many people can recapture their finances. By ditching traditional cable services and opting for streaming platforms, you can save anywhere from $50 to $100 each month.

Evaluate your entertainment expenses and consider switching to on-demand streaming services or free content providers, which typically offer great variety at a lower cost.

- Explore streaming services like Netflix, Hulu, or Disney+.

- Utilize free streaming platforms for movies and shows.

- Consider sharing subscription costs with family or friends.

By cutting the cord, not only do you save money, but you also gain control over your entertainment choices, ensuring that you're not paying for channels or content you never use.

6. Negotiate Bills and Contracts

Many people miss out on potential savings simply due to inaction when it comes to negotiating their bills. Whether it's your cable, internet, or phone plan, contacting your service providers and asking for better rates could lead to substantial savings. Have competitors' offer information ready to present your case effectively.

Don't shy away from expressing loyalty to your service provider; sometimes they offer discounts to keep long-term customers happy.

7. Meal Prep Like a Pro

Meal prepping is a fantastic way to save both time and money throughout the week. By planning your meals ahead, you minimize the temptation to eat out or buy last-minute groceries, which can add up quickly. You can choose satisfying recipes and buy ingredients in bulk for added savings.

A little planning goes a long way. Meal prep is not just about being economical; it also promotes healthier eating, reducing the likelihood of overpriced takeout.

- Plan your meals for the week every Sunday.

- Use simple, budget-friendly recipes.

- Prep ingredients in batches to save time.

As a result, meal prepping can revolutionize both your finances and your diet all at once, making it a worthy addition to any budgeting strategy.

8. Unsubscribe and Declutter

Over time, we often accumulate subscriptions that we no longer use or even remember signing up for. Taking the time to review your monthly subscriptions and canceling those that no longer provide value is a surefire way to free up some quick cash. It's also the perfect opportunity to declutter your financial commitments.

By unsubscribe to unwanted services, you can streamline your monthly expenses and reduce wasteful spending.

- Identify subscriptions you rarely use.

- Evaluate the value of remaining subscriptions.

- Cancel or downgrade plans that aren't worthwhile.

This decluttering can lead to surprising savings and allow you to allocate those funds toward your savings goals.

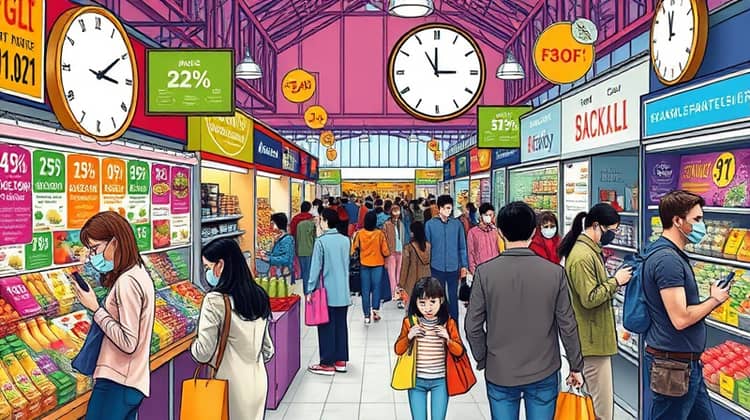

9. Shop Smarter

Being a smart shopper doesn't just mean finding the lowest price; it also means being strategic about when and where you shop. Use price comparison websites or apps that help you find the best deals available, and always check for coupons or loyalty programs that can yield additional savings.

Time your purchases strategically: shopping during sales or off-season can result in significant discounts on items you need.

Additionally, avoid impulse buys by creating a shopping list ahead of time and sticking to it whenever you go to the store. This simple practice ensures you’re buying only what you truly need.

Meanwhile, consider waiting 30 days before making larger purchases to curb impulsive decisions and give yourself time to evaluate your true needs.

10. Review and Adjust Your Budget

Budgeting is not a one-time task; it requires continual review and adjustment. Regularly reviewing your budget allows you to see where you’re spending well and where you may need to cut back.

Life changes, and so do your financial circumstances. Make sure to adjust your budget as needed, whether it’s due to income fluctuations or changes in personal goals. It's perfectly normal for priorities to shift over time, so remain flexible. This ensures your budget works for you, not against you.

A monthly financial review should become part of your routine.

Conclusion

Ultimately, mastering budgeting is about finding what works best for your unique situation. These ten hacks serve as a guide to help you regain control over your finances and steer towards a path of better savings and spending habits.

Remember, the goal is not to deprive but to be mindful of your financial choices. Each small step you take in implementing these hacks can lead to significant improvements in your financial health and savings potential.

Take the time to explore which strategies resonate with you and fit your lifestyle. With determination and a bit of strategy, reaching your financial goals is absolutely achievable.