Credit Card Safety Abroad: 7 Expert Tips You Can't Ignore

Traveling abroad can be exhilarating, but it also comes with its own set of challenges, particularly when it comes to handling your finances. One of the most convenient ways to manage your expenses overseas is through credit cards. They offer better fraud protection and security compared to cash and debit cards, but this also means you need to be extra cautious while using them in unfamiliar environments.

In this article, we'll delve into seven expert tips that will help you keep your credit card information secure while traveling abroad. By following these guidelines, you can enjoy your trip without worrying about potential financial pitfalls.

1. Notify Your Bank and Credit Card Company

Before you embark on your journey, it's essential to inform your bank and credit card companies about your travel plans. This simple step can help prevent your card from being flagged for suspicious activity as you make purchases in foreign locations.

Many banks have sophisticated fraud detection systems that may automatically freeze your card if they detect unfamiliar transactions, leaving you without access to funds during your trip. When you notify them, they can put a travel alert on your account, allowing you to use your card without fuss.

- Call your bank and credit card issuer at least a week before your trip.

- Provide details about your travel dates and destinations.

- Consider confirming if you will be charged foreign transaction fees.

- Ask for recommendations on using your card abroad.

By taking the time to notify your financial institutions, you’ll have peace of mind during your travels and can focus on enjoying every moment.

2. Use a Credit Card Over a Debit Card

When it comes to international travel, using a credit card is usually safer than a debit card. Credit cards typically offer better fraud protection and liability coverage, meaning you're less likely to be held responsible for fraudulent charges.

Debit cards, on the other hand, are often directly linked to your bank account, making it easier for unauthorized transactions to clean out your funds if your card is compromised.

3. Avoid Using Public Wi-Fi for Transactions

In today's technology-driven world, it may be tempting to connect to free public Wi-Fi for convenience. However, public networks can be a breeding ground for cybercriminals looking to steal sensitive information such as your credit card details.

When you connect to these networks, your data may be at risk, making it unwise to enter personal information or make financial transactions while using them.

4. Use ATMs Wisely

Not all ATMs are created equal, particularly when traveling abroad. To minimize security risks, it's important to choose ATMs that are affiliated with your bank or are found in secure locations such as bank branches or well-lit areas with high foot traffic.

Check the ATM before using it for any signs of tampering, such as hidden cameras or unexpected attachments, which are common tactics among skimmers trying to capture your data.

- Use ATMs that are located inside bank branches whenever possible.

- Avoid stand-alone ATMs that may be in unmonitored areas.

- Check for the skimming devices before using the ATM.

- Limit the amount of cash you withdraw at one time.

Implementing these practices will significantly reduce your chances of falling victim to scams or security issues while accessing your money abroad.

5. Be Cautious with Currency Conversion

When making purchases abroad, be mindful of currency conversion rates. Many merchants and ATMs offer to convert prices from the local currency to your home currency, which can sometimes seem convenient.

However, it's often more cost-effective to pay in the local currency. Dynamic currency conversion can come with high fees and can lead to unfavorable exchange rates.

6. Monitor Your Accounts Regularly

While you're enjoying your trip, it's important to keep an eye on your accounts. Make a habit of checking your bank statements and online account every few days to ensure there are no unauthorized charges or suspicious activities.

If you spot anything unusual, report it immediately to your bank or credit card provider. The sooner you take action, the better chance you have of resolving the issue.

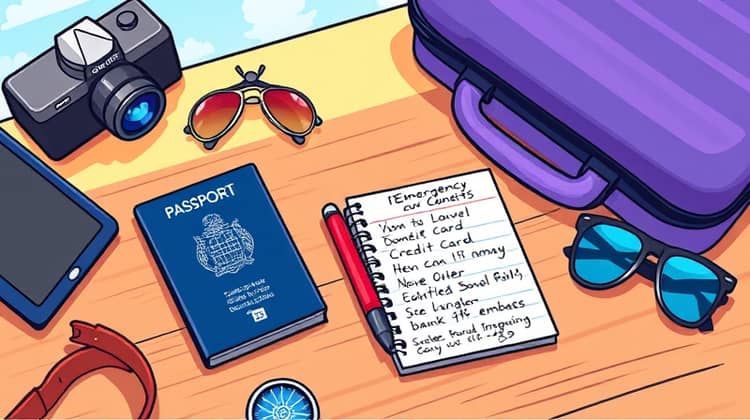

7. Keep Emergency Contact Information Handy

No one wants to think about losing their credit card while traveling, but accidents do happen. Having your card issuer's contact information readily available can save you a lot of stress in case of an emergency.

Make copies of your cards and store this information separately from your card itself. In addition, consider keeping the details of local banks and embassies handy too in case you need assistance.

- Keep a written copy of your credit card numbers and contact info in a secure location.

- Save emergency numbers in your phone, including card issuer contacts.

- Write down or digitally store the addresses of the nearest bank branches and embassies.

- Inform a family member or friend of your travel details and how they can reach you.

By preparing for emergencies in advance, you can minimize the impact of any unfortunate situations while ensuring your travels remain enjoyable.