Crush Your Debt: Top 7 Strategies to Get Back on Track

Managing debt can feel overwhelming, but with the right strategies, it's possible to regain your financial footing. This guide outlines practical methods to help you crush your debt and pave the way for a more secure financial future. Each section offers actionable steps that you can implement immediately.

From creating a budget to seeking professional help, this article provides a comprehensive overview of how you can tackle your debt effectively. By employing these strategies, not only can you manage your current debts, but you can also prevent future financial strain.

Let's dive into the top seven strategies that can help you get back on track and regain control of your finances.

1. Create a Budget

The first step to managing your debt is to create a budget that lays out all your income and expenses. This process helps you understand where your money is going and identifies areas where you can cut back. By tracking your spending, you can make informed decisions about your finances and allocate funds towards paying off your debts.

Begin by listing all sources of income, followed by fixed expenses such as rent or mortgage, utilities, groceries, and any other necessary bills. Once you have a clear picture of your financial situation, you can prioritize your spending.

- Analyze your current spending habits

- Identify non-essential expenses

- Create a plan for allocating your income

With this budget in place, you can now see how much money you can direct towards your debt repayment each month.

2. Snowball vs. Avalanche Method

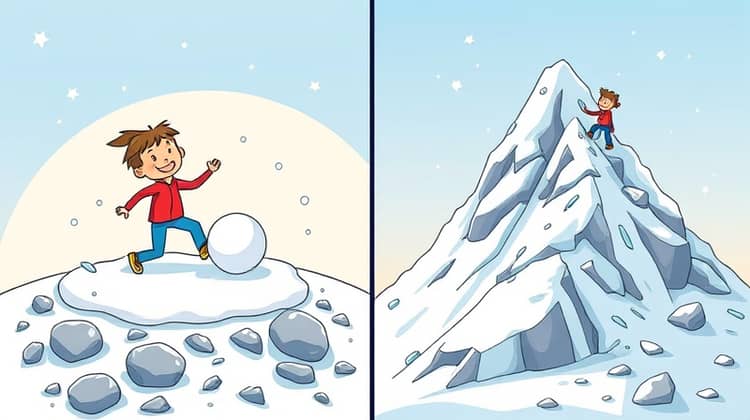

When it comes to paying off debt, there are two popular approaches: the Snowball Method and the Avalanche Method. Each strategy has its benefits, and choosing the right one for you can make a significant difference in your journey to become debt-free.

The Snowball Method focuses on paying off your smallest debts first, regardless of the interest rates. This can create a sense of accomplishment that motivates you to tackle larger debts. In contrast, the Avalanche Method prioritizes debts with the highest interest rates, potentially saving you more money in the long run.

Snowball Method

The Snowball Method is built on the psychology of small wins. By paying off your smaller debts first, you gain momentum as these balances disappear. This motivates you to continue addressing larger debts as you move forward in your debt repayment journey.

Begin by listing your debts from smallest to largest. Make the minimum payments on all debts except for the smallest, to which you’ll allocate any extra funds you can gather. As soon as this debt is paid off, roll that payment into the next smallest debt. This 'snowball' continues until all debts are eliminated.

- List your debts from smallest to largest

- Focus all extra payments on the smallest debt

- Once the smallest debt is paid off, move to the next smallest

- Repeat this process until all debts are paid off

This method can provide emotional boosts, as paying off debts can instill a sense of control and accomplishment.

Avalanche Method

The Avalanche Method, on the other hand, is a mathematical approach that focuses on saving money over time. By tackling debts with the highest interest rates first, you can minimize the amount of interest paid over the lifespan of your debt. This strategy may take longer to see results early on, but ultimately, it can be the more financially sensible choice.

To implement this method, list your debts from highest to lowest interest rate and make minimum payments on all debts except for the one with the highest rate. Put any additional income toward that debt until it is paid off, then move on to the next highest rate.

- List your debts from highest to lowest interest rate

- Focus all extra payments on the debt with the highest interest

- Once that debt is paid off, move to the next highest interest debt

- Repeat until all debts are eliminated

This method is beneficial in the long-term as it can lead to significant savings in interest payments.

3. Negotiate with Creditors

If you find yourself struggling to keep up with payments, consider reaching out to creditors to negotiate your terms. Many creditors would prefer to work with you to ensure they receive some payment rather than risk you defaulting entirely.

You might request a lower interest rate, extended payment terms, or even a temporary forbearance. Be prepared to explain your situation and offer documentation if necessary.

- Contact your creditor directly

- Explain your financial situation clearly

- Ask for a lower interest rate or forbearance

- Be proactive and follow up

Many creditors are willing to negotiate, especially if it means they'll get repaid.

4. Increase Your Income

While cutting expenses is essential, increasing your income can also significantly impact your ability to pay down debt. Look for opportunities to enhance your earning potential, whether through taking a second job, freelancing, or seeking a promotion at your current job.

Consider leveraging your skills or hobbies to create additional streams of income.

- Take on part-time work or freelance gigs

- Sell unwanted items online or through garage sales

- Utilize skills for consulting or tutoring

- Pursue advanced training for higher-paying positions

The more money you have, the faster you can pay off your debts, leading to financial freedom sooner.

5. Cut Unnecessary Expenses

Budgeting gives insight into your spending habits, helping you identify unnecessary expenses to eliminate. Review your monthly expenditures and look for non-essential items to cut. This can free up funds for debt repayment while still meeting essential needs.

Look at subscriptions, dining out, and entertainment costs as potential areas to save.

6. Consider Debt Consolidation

Debt consolidation can be an effective strategy for combining multiple debts into a single payment, possibly at a lower interest rate. This can simplify your financial obligations and potentially reduce your monthly payments. However, it's crucial to weigh the long-term effects and costs of this method.

Research and compare various consolidation options such as personal loans or secured loans, and ensure you understand the terms before proceeding.

7. Seek Professional Help

If you find yourself overwhelmed, do not hesitate to seek professional assistance. Financial advisors or credit counseling services can provide valuable insights and a structured plan to manage your debts effectively.

These professionals can also negotiate with creditors on your behalf and help you understand your financial health better.

- Find reputable credit counseling services

- Confirm their credentials and accreditations

- Prepare necessary documentation for discussions

Finding the right support can make the process of debt management much more manageable and provide accountability.

Stay Motivated

Staying motivated throughout your debt repayment journey is crucial. It’s easy to get discouraged when progress seems slow, but setting milestones and celebrating small victories can help keep your spirits high.

Create a vision board of your goals or a debt repayment path chart to visualize your achievements. Reminding yourself of the financial freedom ahead can ignite your drive.