Debt Prioritization Strategies: Pay Off These First for Financial Relief

Debt can feel overwhelming, especially when it seems to pile up without clear solutions in sight. For many, financial relief comes from knowing where to start. Understanding which debts to tackle first can significantly ease one's financial burden and help regain control over personal finances.

In this guide, we will explore the most pressing debts that require immediate attention and prioritize them logically. Making informed decisions in handling debts not only brings relief but also paves the way towards financial stability and peace of mind.

With a clear strategy in place, you can navigate through the storm of debt and emerge more enlightened and organized. Let's take a closer look at the notable culprits that could be draining your finances.

1. High-Interest Debts: The Financial Vampire

High-interest debts can be likened to financial vampires—they suck the life out of your budget and leave you with significantly less. Most commonly seen in credit cards and certain personal loans, the exorbitant interest rates these debts accrue can lead to a never-ending cycle of payments that seem to only cover the interest rather than reducing the principal amount owed.

When faced with multiple debts, giving the highest priority to the ones with the highest interest rates is crucial. By tackling these first, you can stop the relentless increase of what you owe, providing a clearer path to financial recovery.

- Credit card debt with interest rates above 15%

- Payday loans with exorbitant fees

- Medical bills that have high late fees

By prioritizing high-interest debts, you can make a more significant impact on your overall financial health, creating a sense of relief as you see your debts decrease more substantially over time.

2. Payday Loans: The Cycle of Doom

Payday loans often appear to be a quick fix to financial needs. However, they usually come with exceedingly high fees and short repayment periods that can trap individuals in a cycle of perpetual borrowing.

The difficult reality is that many borrowers find themselves unable to repay these loans on time, leading to further borrowing, and thus, worsening their financial situation.

Breaking this cycle is essential. Start paying off these loans as soon as possible to escape the never-ending trap they often create.

3. Credit Card Debts: The Plastic Trap

Credit card debts are another financial trap that many fall into. The convenience of using credit cards can cloud the reality of accumulating debt, leading to surprise bills at the end of the month.

Making only the minimum payments can lead to sky-high interest charges and prolong the debt cycle. It's important to devise a strategy for paying these cards off proactively.

- Focus on paying off cards with the highest interest rates first

- Consider balance transfers to lower-interest cards

- Set a monthly limit to control further spending

Taking control of credit card debts can significantly enhance your financial freedom, allowing you to break free from high-interest traps and regain control over your spending habits.

4. Personal Loans: The Silent Burden

Personal loans often come with fixed repayment terms, making them seem manageable. However, they can quickly become a burden if left unchecked. The calm before the storm is deceiving, as missing just one payment can lead to penalties and additional stress.

It's imperative to understand the terms and conditions of personal loans, as well as how they fit into your overall financial situation.

5. Medical Debts: Health Over Wealth

Medical debts can be some of the most stressful and unexpected financial burdens. The rising costs of healthcare mean that many people find themselves facing bills that are insurmountable without proper planning.

While some medical debts may be negotiable and offer various payment options, it is essential to address these debts promptly to avoid further interest or legal complications.

- Negotiate medical bills with healthcare providers

- Explore payment plan options

- Seek financial assistance programs

Tackling medical debts not only helps in regaining your financial peace but also secures better health outcomes by enabling you to afford necessary medications and treatments without feeling the burden of debt.

6. Car Title Loans: The Risky Ride

Car title loans may seem like an easy solution for immediate cash, but they come at the cost of risking your vehicle as collateral. The problem arises when borrowers cannot repay the loans on time, leading to losing their vehicles altogether.

The cycle of borrowing against a vehicle can perpetuate further financial struggles, so addressing these loans with urgency is paramount to avoid losing a vital asset and further financial distress.

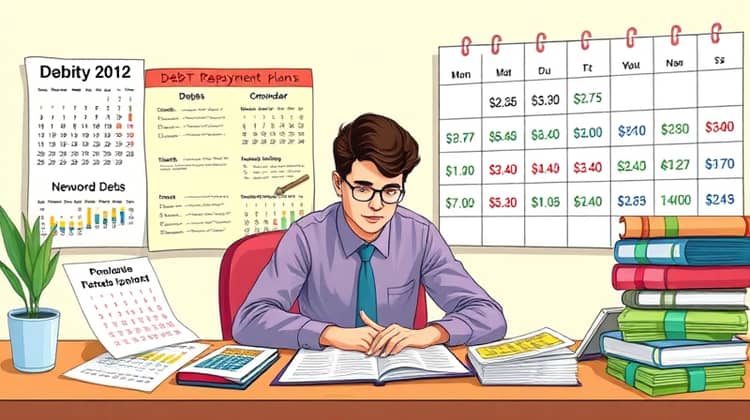

Creating a Debt Repayment Plan

Creating a structured debt repayment plan is one of the best ways to achieve financial stability. Start by listing all your debts clearly, specifying the total owed, interest rates, and due dates. This visibility helps in prioritizing which debts to pay first based on their urgency and impact on your finances.

Next, allocate funds strategically to ensure that high-interest debts are prioritized while making minimum payments on the others. Stick to this plan for sustained financial relief.

- List out all debts according to the interest rate

- Allocate extra payments towards the highest interest debt

- Continue until all debts are settled

By diligently following a debt repayment plan, you will progressively feel the weight lift off your shoulders, opening doors to better financial management and freedom.

Conclusion

Prioritizing your debts is not just about eliminating financial burdens; it's about reclaiming your peace of mind and establishing a healthier relationship with money. By focusing on high-interest debts first and tackling them strategically, you can expose yourself to avenues for financial recovery that seemed unreachable at first.

The road to financial freedom is often paved with hard decisions and discipline, but these actions will ultimately lead to a more secure and stable financial future. Remember that consistency is key—stay committed to your repayment plan and watch as your debts shrink and your financial health strengthens.