Student Loans: Effective Methods to Eliminate Debt Quickly

Student loan debt has become a significant issue for many graduates, leaving them uncertain and stressed about their financial future. With rising tuition fees, the current generation is taking on more debt than ever before, often before even entering the workforce. Learning effective strategies to tackle student loan debt is crucial for achieving financial freedom and peace of mind.

In this blog post, we will outline practical methods that can help you eliminate your student loan debt quickly and efficiently. From understanding your loans to exploring potential forgiveness programs, this guide aims to provide you with actionable steps that can lead to a debt-free life sooner than you might expect. Prepare to take control of your finances and pave the way to a brighter future!

1. Understand Your Loans

Before you can effectively pay down your student loans, it's essential to fully understand the terms and conditions associated with each loan you have. This includes the interest rates, repayment terms, and any available options for deferment or forbearance. Many students take out loans without fully grasping the long-term consequences, which can lead to stress further down the road. Spend some time organizing all your loan information in one place, so you can clearly see what you owe and what your payment options are.

Another crucial aspect of understanding your loans is knowing whether they are federal or private loans. Federal loans typically offer lower interest rates and more flexible repayment options than private loans. This knowledge will help you prioritize which loans to pay off first and which payment strategies to use.

- List each loan you have, including the total balance, interest rate, and monthly payment.

- Identify whether the loans are federal or private to understand your repayment options better.

- Research potential benefits, such as loan forgiveness programs or Income-Driven Repayment Plans that could apply to your situation.

Once you have a clear understanding of your loans, you will be better prepared to tackle them effectively. Take control of this information, as it will be your roadmap to financial freedom. Understanding your loans can alleviate confusion and facilitate better decision-making in your repayment journey.

2. Create a Budget

Creating a budget is a fundamental step in managing your student loan payments effectively. A well-structured budget allows you to allocate your income efficiently, ensuring that you're making timely payments while also covering your necessary living expenses. Begin by assessing your total income, then subtract your fixed expenses, such as rent, groceries, and utilities, from that total.

From there, you'll be able to see how much money you have left over each month for discretionary spending and, importantly, for loan repayments. This will help you identify areas where you can cut back and ultimately pay off your loans sooner.

- List all sources of monthly income, including salary, side jobs, or any additional income.

- Record all fixed and variable expenses to determine where money is being spent and identify areas to cut back.

- Set aside a specific amount for loan repayment each month, treating it like any other non-negotiable bill.

A budget not only helps you manage your finances better, but it also paves the way for you to make additional payments towards your student loans or save for emergencies. Following your budget closely and adhering to it can provide peace of mind and less financial stress in the long run.

3. Find Extra Income

Finding additional sources of income can accelerate your journey toward paying off your student loans. In today's gig economy, there are countless opportunities to earn extra money on the side. Whether it's freelance work, part-time jobs, or leveraging your skills for tutoring, the options are more abundant than ever.

Consider your hobbies and professional skills; turn them into income-generating activities to supplement your primary earnings. Every dollar earned can bring you one step closer to debt freedom.

- Freelancing based on your skills (writing, graphic design, coding, etc.).

- Tutoring students in subjects you excel at, either online or in person.

- Participating in gig economy jobs like rideshare driving or food delivery.

By implementing these strategies, you can generate extra income that can be directly applied to your loan payments. The faster you can increase your income, the quicker you can reduce your student debt than initially anticipated.

4. Pay More Than the Minimum

One of the simplest yet most effective strategies for paying off student loans quickly is to pay more than the minimum required payment each month. While making minimum payments may seem manageable, it often extends your loan term significantly, resulting in more interest paid over time. Making additional payments can drastically reduce your principal balance and the overall interest you'll pay.

Consider applying any bonuses, tax refunds, or extra money you earn towards your loans. Even small amounts can add up quickly and have a significant impact on your repayment timeline. Establishing this habit early in your repayment period can set you on the right path to being debt-free much sooner.

5. Refinance Your Loans

Refinancing your student loans can lead to lower interest rates and a more manageable repayment structure. This process involves taking out a new loan to pay off your existing loans, often at a better interest rate. For graduates with a strong credit score and stable income, refinancing can result in significant savings over the life of the loan.

However, before jumping into refinancing, carefully consider whether you will lose any benefits associated with your federal loans, such as income-driven repayment plans or loan forgiveness opportunities.

6. Explore Loan Forgiveness Programs

There are various loan forgiveness programs available which can provide relief from student debt under specific conditions. Federal programs like Public Service Loan Forgiveness (PSLF) offer complete loan forgiveness to individuals who serve in qualifying public service jobs for a certain number of years. This can mean the difference between a decade of debt and a debt-free life after just a few years of service.

Research what forgiveness options you may qualify for, potentially significantly reducing the amount you'll ultimately need to pay back.

- Public Service Loan Forgiveness (PSLF) for qualifying public service jobs.

- Teacher Loan Forgiveness for teachers in low-income schools.

- Income-Driven Repayment Plan forgiveness after 20-25 years of qualifying payments.

Taking full advantage of loan forgiveness programs can substantially lighten your student loan burden. Make sure to track your progress and stay informed about any changes to these programs, as they can directly affect your repayment strategy.

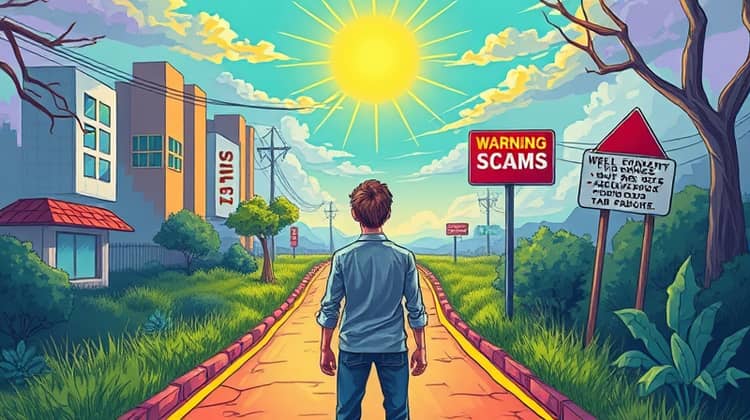

7. Avoid Scams

As you navigate the journey of repaying your student loans, stay vigilant against scams promising easy solutions or loan forgiveness for a fee. Many predatory companies exploit borrowers' desperation by charging hefty sums for advice and services that can often be managed on your own or through government resources for free. Trust your instincts if anything sounds too good to be true; it likely is.

8. Stay Motivated and Track Progress

Maintaining motivation during your debt repayment journey is crucial for long-term success. Set specific, achievable goals, such as paying off a certain amount of your loans each year. This not only helps you track your progress but also provides a sense of accomplishment as you see that debt shrink.

Tracking your progress can help highlight the milestones you achieve along the way, making the path forward feel more manageable and encouraging. Keeping a journal or using financial apps can provide not only insight into your financial situation but also keep your spirits high by reminding you of your hard work and dedication.

Conclusion

Student loan debt may feel overwhelming, but by implementing the strategies discussed, you can take charge of your financial future. Understanding the loans you have, creating a comprehensive budget, seeking extra income opportunities, and exploring forgiveness programs are just a few essential steps among many that can speed up your repayment process. Stay focused and motivated, and remember that every small step counts toward a larger goal.

Keeping aware of potential scams and ensuring you stay informed can safeguard you against common pitfalls many borrowers fall victim to. Each borrower has a unique situation, so tailor these strategies to fit your individual needs and circumstances.

With a determined mindset and strategic planning, you can eliminate your student loans more quickly than you might think. The journey toward being debt-free can open doors to further opportunities, whether in your personal life or career, leading to a brighter and more financially secure future.